Responsible investment policies at Dutch pension funds remain insufficient in spite of some progress. This is evident from a new study by the Fair Pension Guide, a collaboration between PAX and four other Dutch NGOs.

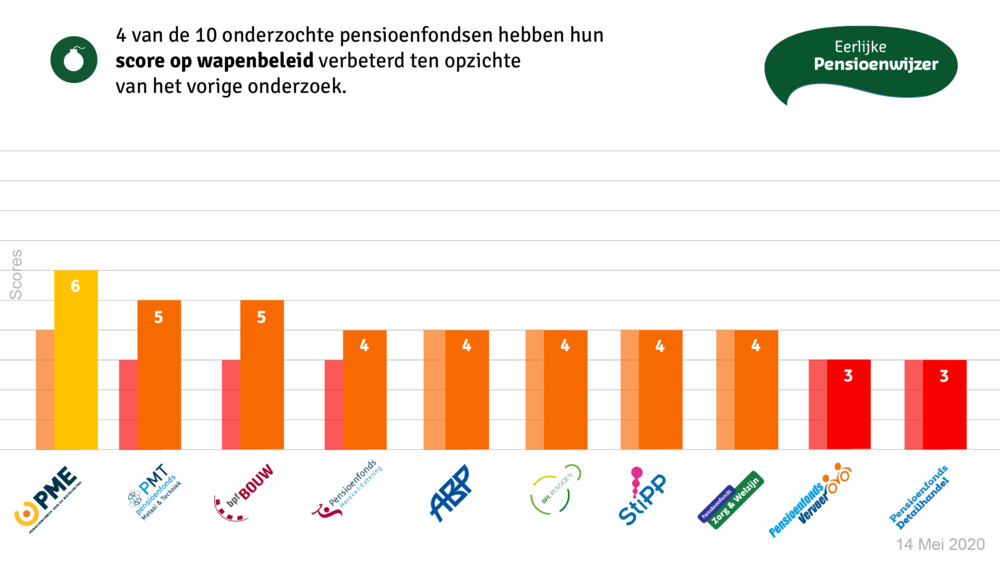

The Fair Pension Guide assesses the publicly available investment policy of the ten largest pension funds on 15 themes such as human rights, climate change and transparency. In total, 44 scores improved compared to last year as a result of policy changes.

Cor Oudes of PAX, on behalf of the Fair Pension Guide: “A number of really low scores are now creeping up towards being sufficient, but the pension funds still have a lot to do before we can talk about a sustainable pension sector. The sector manages a total of nearly one-and-a-half trillion euros and can really make a difference worldwide.”

Slow improvement

All the Dutch pension funds still score poorly in failing to take the environment and animal welfare into account when investing. None of the funds even recognize the most basic values in dealing with animals. All funds score a 1 on this topic, the lowest score. A number of funds did improve policies regarding human rights, and therefore raised their scores. However, only one pension fund, PMT, has reached a satisfactory score in this area.

Dutch pension funds have also developed more policies on climate change and labour rights. The funds implemented 23 improvements in their investment policy to combat climate change. However, none of the funds score sufficient for this theme. Half of the funds now score almost satisfactory for policies concerning labour rights.

Coalition

The Fair Pension Guide is a collaboration between PAX and Amnesty International, Milieudefensie/Friends of the Earth NL, Oxfam Novib, and World Animal Protection.

See here to download an Enlish summary of the report

See here for the latest scores (in Dutch)

See here for more information about the Fair Finance International network